The Value of Stocks and How it Affects a Stock's Price

Determining the value of stocks, or stock valuation, is the process of valuing a stock based on several financial statistics. Sometimes when looking at the stock price, it can be misleading, especially when everyone is hyped up about something going on with the company and driving the price up with mindless buying.

Stocks that rise in price too fast are generally way overvalued and eventually turn the other direction in a hurry as the hype wears off and people pull out their profits. But many investors get hurt in the frenzy because they don't know how to properly value a stock for themselves to see if it's even worth investing in.

If you don't know what you're doing, following the hype is the fastest way to lose all of your trading capital.

Learning how to figure out the value of stocks will help you decide if you are going to buy into it or just to stay away from it so you don't risk loosing money. Yes, overvalued, hyped up stocks can make you a lot of money, but most people will lose out, especially if you can't watch the market all hours of the day.

What is the Market Value of a Company

When a company IPOs (Initial Public Offering), a company's market capitalization (market cap) is valued by a separate entity (usually by an investment bank). During this valuation, they determine the number of shares that will be offered and the price per share.

If the company has a value of $1 million, they may issue 1 million shares at $1.00 per share.

Market capitalization or market cap is the important number when considering the value of stocks. After the company IPOs, its value changes as the company grows.

Once the company goes public, share price changes up and down with many influences, including supply and demand of the stock, company growth, and earnings.

But the price quickly gets over or under valued buy emotional trading.

How is Value of Stocks Calculated

Before you can find the true value of what a stock should be, you must determine the market cap. One way this is done is by utilizing the asset approach (assets - liabilities = value).

The market approach is the second method and values the company according to the value of other similar companies. The market approach is the easiest, but not as accurate because all companies are a little different from one another.

But if you can get an average from a couple of the similar companies (multiply the cost per share by the total number of shares for each and divide by the number of companies used). The value of the company would be the average or in between the high and low.

A third approach uses income. This is done by dividing the annual earnings by the capitalization rate.

You can also determine market capitalization by taking the share price and multiplying it by the number of shares outstanding. This is my favorite way.

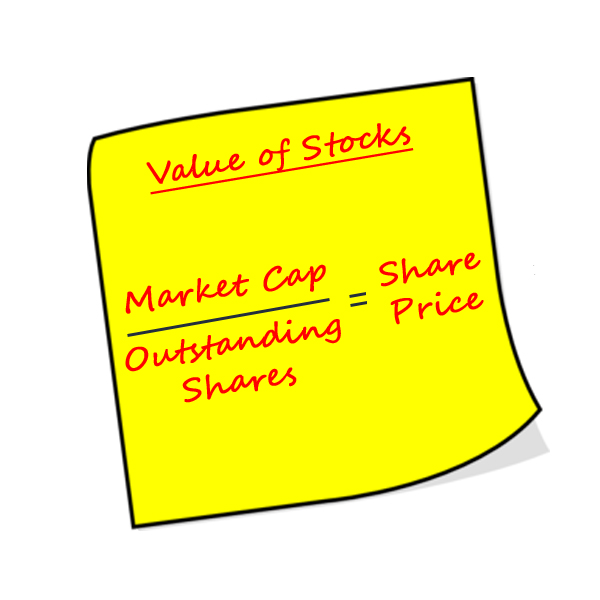

Once you have a good market cap for the company, you can easily figure out an accurate value of stocks or what each share should cost.

Look at the number of shares outstanding for that company in a daily detailed quote for the stock. Once you have the number, divide market cap by the number of shares outstanding.

This gives you the expected share price that you should be trading at.

Determining an Overvalued or Undervalued Stock

This seems like a lot of research, but is worth every minute of it. It can determine if you are paying too much for a share or if it is a good deal (a lot less than expected).

After determining value of stocks, simply check the stock's price, compare it to the stock valuation figured earlier.

Say the valuation of the stock was $34.00, but the actual stock price is $59.00. Based on this exaggerated difference, the stock is overvalued and you should use caution when trading it (meaning it could try to adjust back down to where it's worth at the time).

On the inverse, if the stock valuation was $34.00 and the actual price is $25.00, the stock is undervalued. This means you may be getting the stock at a very good price and it could adjust up to become more accurately valued.

An adjustment of the value of the stock can show up as a large gap to meet the price in either direction. If the price gaps away from expected (such as gapping up when it should be going down), then you should reevaluate the stock valuation to make sure it is accurate.

Another thing that causes a large gap in stock price is a company adding more shares to the total amount of shares it has to trade. Either way, when a gap occurs, it may indicate some kind of adjustment that corrected the price of the stock to an accurate value.

Knowing the value of stocks is very important for the stock market trader because some of the greatest looking stock prices or movements of stock price could be the most dangerous thing to your portfolio. People get over excited about a stock, go all in, and lose a majority of it.

You should never trade a stock long term before you have done an assessment of its value first. If it is way overvalued, stay safe and stay away. If it is way undervalued, find out why it is undervalued before buying it. Then, periodically check it to make sure it's still within where the price should be. If it becomes overvalued while holding it, it may be time to take your profits and sell.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.