Use High Dividend Stocks to Benefit Your Portfolio

High dividend stocks are an additional way to add more money to your portfolio without it coming from your own pocket. This "free" money added to your cash account or back into the stock itself can help grow your investment faster that with gains alone.

When researching stocks for your portfolio, you should not only look for your buy criteria to be met, but should always consider whether the stock has dividends or not.

For expected short-term trading, this is not as important because you will most likely sell the stock before the dividend is funded to your account. But if you are building your long-term investment fund, dividends are a big help.

Generally, when you buy and sell stocks, you have to pay a small fee to make the transaction. This will change the breakeven point for that stock in your portfolio.

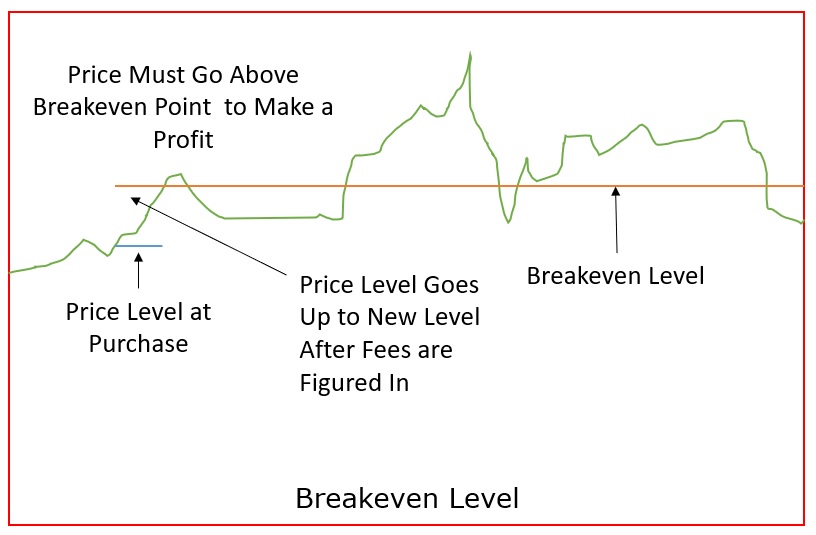

In the following example, you will see how high dividend stocks affects the breakeven point so you can profit even more when applied. The image below shows the breakeven point of a stock.

How High Dividend Stocks Affect Breakeven Point

In the below examples, you will see exactly how a dividend affects the breakeven level of a stock and how it can improve your profits. The first example is with no dividends, the second example is with dividends.

Example 1 - No Dividends

Stock Price = $1.00 per Share

Invested Cash (Net Cost) = $200.00

Shares Purchased = 200

Cost for Buying = $4.95

Cost for Selling = $4.95

Total Cost for Purchase = $209.90

Breakeven = (Amount Invested + Cost for Buying + Cost for Selling) / Total Shares

Breakeven Point (Actual Cost per Share) = $1.0495

That's just $0.0495 more per share than you invested, which means the stock price must go that much higher in order to start making a profit. It doesn't sound like much, but it all depends on where the resistance level is for the stock.

Now, let's figure in a $0.05 dividend for the same stock paid quarterly. That is $0.20 per year.

Example 2 - With Dividends

Stock Price = $1.00 per Share

Invested Cash for 1 year (Net Cost) = $200.00

Dividend Reinvested (200 x .20) = $40.00 (does not count as invested)

Shares Purchased with Investment = 200

Shares Purchased with Dividends (depends on price - example uses same price) = 40

Total Shares Owned = 240

Cost for Buying = $4.95

Cost for Selling = $4.95

Total Cost for Purchase = $209.90

Breakeven = (Amount Invested + Cost for Buying + Cost for Selling) / Total Shares

Breakeven Point (Actual Cost per Share) = $0.8745

With dividends, you added $40.00 more dollars to your original investment at no cost. This increased your number of shares to 240 because they were purchased at a $1.00 each with this example. Take the total cost of the purchase and divide by the new number of shares and the breakeven point dropped to $0.8745.

If the price never drops below $0.8745, you are already in profit. The actual cost per share over the one year period dropped by $0.1254 per share.

Dollar Cost Averaging With Dividends and Regular Investments

Back when I first started investing in stock, I invested $100.00 per month in five different stocks. So each stock got $20.00 added to it (free to buy, not so free to sell). Each month, the stock price was either higher or lower based on the market. Every time I invested, it averaged the price of the stock to lower or raise the breakeven point.

When you invest in high dividend stocks, each quarter or each year (depending on the dividend payout schedule) you are dollar cost averaging the price of you stock to lower the overall cost per share.

There is a chance if a stock price drops too much that your cost per share will actually go up. In cases like this, you can choose to have dividends added to your cash account until and reinvest them with other personal investment (for a cost if your broker system charges). This defeats the purpose of no-cost purchase of shares with your reinvested dividends.

To summarize, high dividend stocks greatly help your investment by adding money into your investment periodically without costing the fees, they average out the price of the stock to lower the breakeven point of the share price, and can significantly increase your gains over time.

Here's some help to find some of the best high dividend paying stocks on the market.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.