Compounding in Trading to Grow a Portfolio Exponentially

Compounding in trading is the key to a successful portfolio. Having a set plan of how you invest and where your profits go will help your portfolio grow exceptionally fast if used with a winning buy/sell strategy.

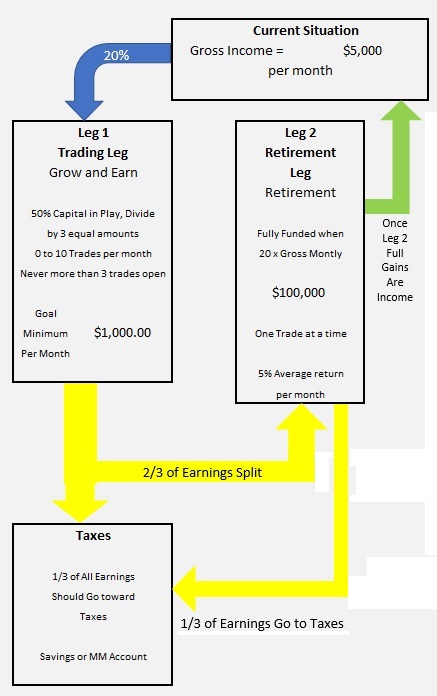

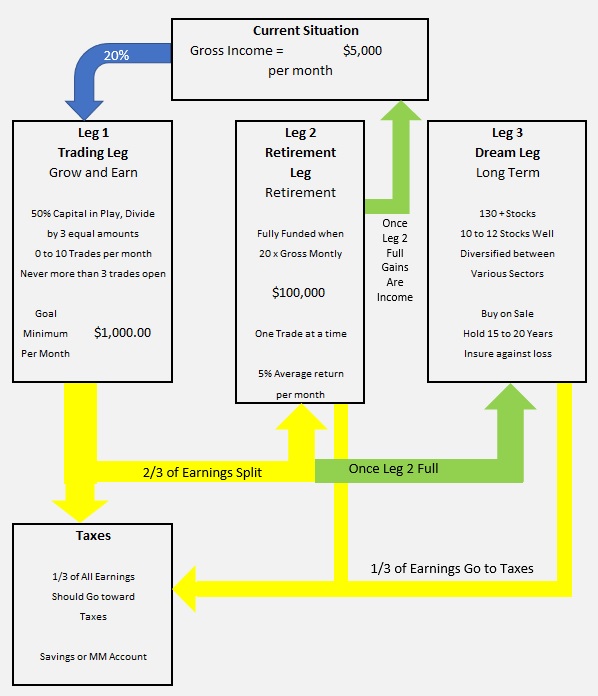

Have you heard of the three-leg portfolio management system before? They are sometimes referred to as trading legs. Well, if not, you are in for a real treat because it shows you how compounding your profits a certain way can set you up for the rest of your life in a short amount of time.

The way compounding in trading works is that it protects your trading capital while your growth trading account funds your other trading legs. This maximizes your return on investment based on your initial personally invested money.

Compounding in Trading Strategy Revealed

There are several key things to remember while setting up this three-trading-leg portfolio strategy. Each leg is explained in detail and shows how compounding can rapidly grow your portfolio beyond retirement (enough cash flow from your gains to supplement your monthly income each month).

Remember, this demonstration is theoretical and not exactly how it may work. Results will vary based on many factors, but the structure and capabilities exist. Follow along and see the potential of the Compounding in Trading Legs strategy as a base for your portfolio trading activities.

The Trading Leg

The first leg in your portfolio should be the Trading Leg.

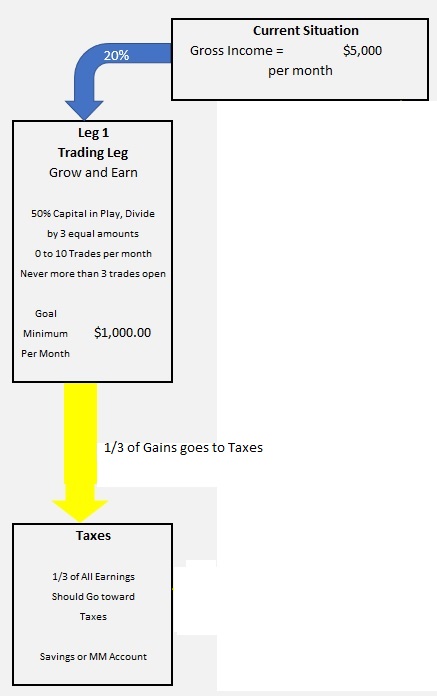

The Trading Leg is your Growth and Earning leg. This is the first place your trading capital goes when you personally invest in it from your current income streams. There is no maximum amount for this account, but there are some rules.

When money goes into this account, it is ready to invest in stocks. When you put money in this account, divide it in half right away.

Say you deposit $1,000.00 in your Trading Leg (which is 20% of $5,000.00). Divide it by 2. You have $500.00.

This is the amount you can actively trade.

Do not touch the other $500.00.

Now, of that $500.00, divide that by 3. That is three equal parts or $166.67 each. This is the amount you can invest in ONE stock.

There is a major rule for this trading leg. You never want to have more than 3 open trades at one time. You are shooting for 0 to 10 trades per month (but never more than 3 open at at time).

The stocks you want to trade in this account are the ones that tend to go up for a week or so with greater than $2.00 average gains in a week.

Buy them at the low (or when it hits the support level) and sell them when they reach the resistance level. You want faster moving or more volatile stocks in your Trading Leg. These trades are for quick gains.

None of the gains you make in your Trading Leg stay in your Trading Leg. You only retain your original amount of trading capital and use that on your next trade in your Trading Leg.

The only way the Trading Leg grows is through personal investment (the 20% of your gross income per month).

Remember, only 3 open trades at a time and never more than 50% of your trading capital being invested at a time.

The Retirement Leg

The Retirement Leg is where compounding in trading legs actually starts. Of course, you are adding to your Trading Leg every month, which is compounding, but this is where you see real compounding in action.

Of course, if you are trading small amounts in your Trading Leg at first, the growth will be a little slow. This is good because over time, you gain experience and will make better trades in the future vice first starting out. But it doesn't really matter how much you are investing or how much you are gaining, it will grow if it is gaining.

This profit in your Trading Leg immediately leaves and is divided by 3. One third of your profits goes to a cash or money market account for taxes. This money should never be used for anything other than paying taxes at the end of the year (in case you make enough to adjust your taxes enough so you have to pay out).

The other 2/3rds of your profit goes to the second Leg, the Retirement Leg.

Like your Trading Leg (the high growth or earning leg), your Retirement Leg has a purpose. As the name implies, this account is for your retirement.

What is retirement? When your gains from your Retirement Leg consistently equal your monthly gross income (after taxes).

This is a long term account with longer term trades. This account should only have one active trade in it at a time (100% of your capital in this account). This is a good stock that you want to hold for a long term, but consistently goes up over the long term.

The maximum amount for this account is 20 times your gross income. So, if you make $5,000.00 per month, the maximum amount in this account will be $100,000.00.

Wait... What? Only $100,000.00. That doesn't seem right. Not when everyone says you need at least $400,000.00 to retire (thus the reason for the 401K).

Bear with me...

You will see why in a second.

The stocks you want to buy in this leg (only one at a time) should average at least a 5% return per month. This is key. If the compounding in trading doesn't happen at least 5% each month, it won't work. If it's more, that's even better for compounding.

This means if you have $1,000.00 invested in one stock, you are gaining an average of $50.00 per month on this stock every month.

At the same time, remember, you are still actively trading on your Trading Leg, continuously funding this account. It is always recommended buying at the correct times, so you must look at your Retirement Leg to see when the right times to buy are. Whatever you have ready to buy, buy some more of that stock when the time is right. This is what creates compounding in trading.

Remember, if you sell your stock for a gain in this account, you must pull out 1/3 of that gain for taxes. It goes in the same Tax account as the Trading Leg.

When the Retirement Leg reaches its maximum amount (based on your gross income per month times 20), everything over that rolls into the third and last leg of your portfolio model.

This is where the compounding in trading magic happens. You maximum in the Retirement Leg is $100,000.00. Any over that rolls into your budget as income, which at this point should be the same ($100,000.00 x 5% = $5,000.00 per month) as your current gross income. Theoretically, at this point you can retire from your job. But with 1/3 taxes coming out of the gains, you should wait at least 1 more year after hitting that point to net $5,000.00 from this account per month.

The Dream Leg

The Dream Leg is the final leg in your portfolio. This is a long term investing account, diversified over several sectors and should contain 10 to 20 long term trending stocks. These are stocks you want to hold for 15 to 20 years, insuring them for loss of course.

This is the leg that you will be living off of, having fun with, and doing the things you couldn't normally do after you retire. There is no limit to this account and there aren't any restrictions like the first two legs.

Any time you sell a stock for gain in the Dream Leg, 1/3 of the gains goes to your Tax account. The rest of the gains are rolled back into other trades. 100% of your capital in this account should be in trades at all times.

If you need money for a vacation in retirement, it can come from your Dream Leg. Your Retirement Leg should be the money used to pay expenses into your retirement. Your Dream Leg is for everything else beyond your normal expenses.

Putting the Compounding in Trading Legs Strategy Together

Now that you know the entire Compounding in Trading Legs Portfolio System, you need to see it in action to really understand the power of compounding and how quickly you can reach retirement with this trading system.

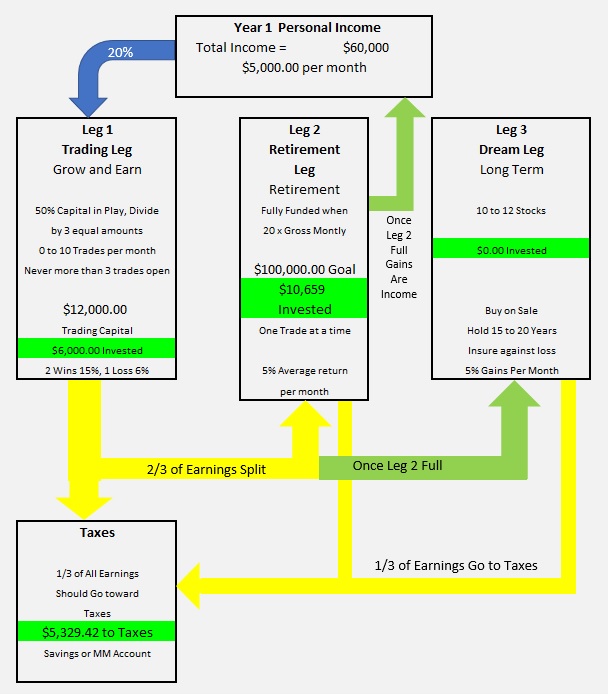

For my theoretical math, I used a gross income of $5,000.00 per month. 20% of that is $1,000.00 which goes to the Trading Leg. The Retirement Leg Maximum Invest from Trading Leg Gains is 20 x Gross Income Monthly, or $100,000.00.

In the trading leg, I used 2 winning trades (15% gain each) and 1 losing trade (6% loss). In the Retirement Leg, I used a monthly gain of 5% on the balance of the Retirement Leg. In the Dream Leg, I used a 5% gain on the balance of the account.

Here are the compounding in trading legs results:

End of Year 1:

Total Capital in Trading Leg: $12,000.00

Total Personal Investment Used: $6,000.00

Total in Retirement Leg: $10,658.85

Total to Taxes: $5,329.42

Total Profits for Year 1: $15,988.27

1st Year ROI: 266.47%

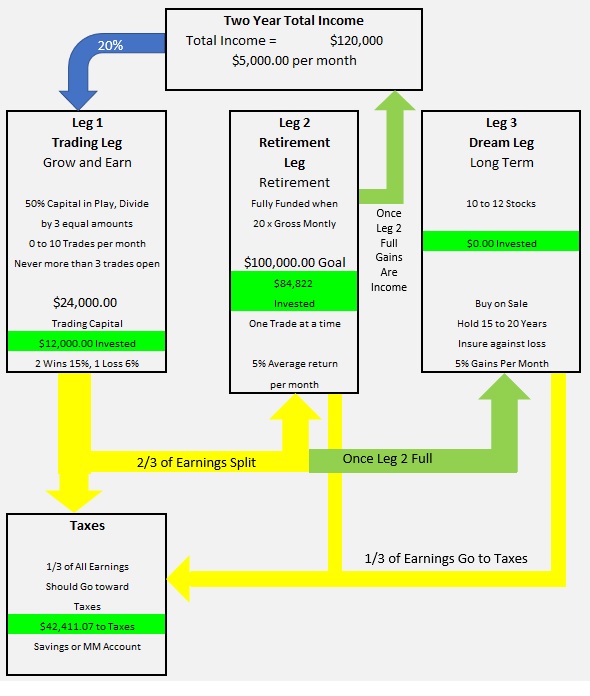

End of Year 2:

Total Capital in Trading Leg: $24,000.00

Total Personal Investment Used: $12,000.00

Total in Retirement Leg: $84,822.14

Total to Taxes: $42,411.07

Total Profits for Year 1: $127,233.21

1st Year ROI: 1,060.28%

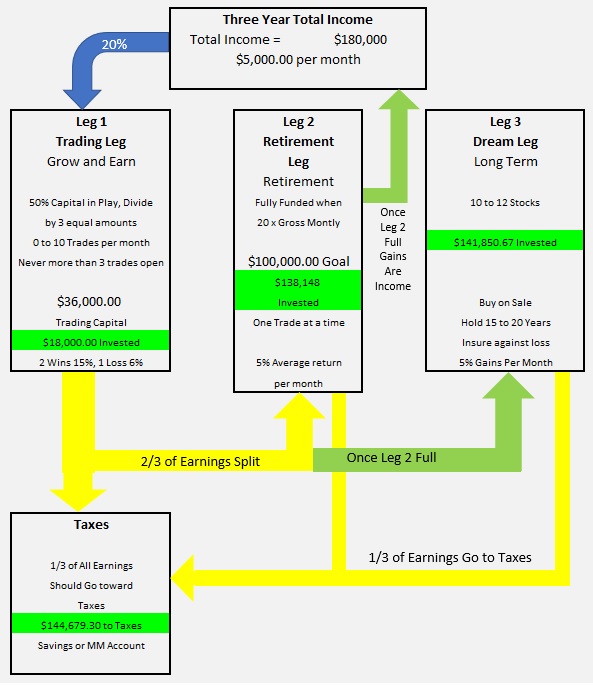

End of Year 3:

Total Capital in Trading Leg: $36,000.00

Total Personal Investment Used: $18,000.00

Total in Retirement Leg: $138,147.88

In March, Start Dream Leg

Total in Dream Leg: $141,850.67

Total to Taxes: $144,679.30

Total Profits for Year 1: $424,677.85

1st Year ROI: 2,359.321%

As you can see, compounding in trading legs really works. And it works fast. By April on the fourth year, you will be netting over $5,000.00 per month over taxes in your Retirement Leg and can move that money over to your budget as income, essentially ditching your job forever (as long as you maintain your portfolio legs).

So, how much time does this compounding model take each day. Once you learn and work with your buying and selling strategies, you can get your daily research down to about an hour a day (at the most). When you have all active trades, it can take as little as 10 minutes a day to monitor them for sell points and you can spend as much time looking at other stocks as you like.

Compounding in trading can really benefit your portfolio growth in a way blind investing never can. This strategy provides you with a focal point that keeps you safe and on track the entire time you have money invested.

It keeps your money safe because you are forced to pay attention to what everything is doing, you never have more than half of your personal investment in action at a time, and all of the rest of the money invested is from gains so it doesn't matter (personally) as much and won't affect you emotionally like your own personal investment can.

Contact me for more information about the compounding in trading legs method of portfolio management for more explanation of to receive a copy of the excel spreadsheet calculator for this example.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.